Get Quote

News

- METALS-LME aluminium teeters near 3-mth low as China smelters ramp upMELBOURNE, March 15 (Reuters) - London aluminium hovered near its lowest since late December on Thursday on expectations of rising supply as China's winter pollution controls expire. FUNDAMENTALS * ALUMINIUM: London Metal Exchange aluminium crept up 0.2 percent to $2,094 a tonne, having slipped to the weakest since Dec. 19 at $2,087 on Wednesday. Support is seen at the 200 moving day average at $2,083, a break of which could trigger a steeper correction, as it would send a sell signal to momentum following funds. * SHFE: Shanghai aluminium hit its lowest in 14 months at 13,820 yuan ($2,191) on Tuesday and last traded at 13,950 yuan. * SMOG: The winter heating season ended on Thursday.Aluminium smelters in 28 northern Chinese cities had been told to reduce output by at least 30 percent from Nov. 15 to March 15, although the actual volume cut was below expectations,putting pressure on prices. * OUTPUT: China's aluminium production fell 1.8 percent in January-February from a year earlier, data showed on Wednesday,as the country's pollution crackdown and supply-side reform kicked in. An estimated 4.4 million tonnes of new capacity are expected to be completed this year * STOCKS: Shfe aluminium AL-STX-SGH stockpiles held at exchange warehouses are within a whisker of record highs near 850,000 tonnes, reflecting a surplus of domestic material. * DISCOUNT: The discount between cash Shfe andphysical prices AL-A00-CCNMM has narrowed to 35 yuan from 385 three weeks ago, reflecting a tightening market and an expected pick-up in nearby demand. * COPPER: LME copper traded up 0.3 percent at $7,006 a tonne by 0157 GMT, adding to 0.6 percent gains from the previous session. Prices are expected to rise over the coming month as industrial production in the seasonally strongest second quarter ramps up. * TRADE: The Trump administration is pressing China to cut its trade surplus with the United States by $100 billion, a White House spokeswoman said on Wednesday. * COBALT: Glencore, the world's biggest producer of cobalt, has agreed to sell around a third of its cobalt production over the next three years to Chinese battery recycler GEM. * SMOG: Eastern China's Jiangsu province will step up its war on pollution and focus on "high-quality development" following a spike in smog early this year. * DOLLAR: Supporting metals, the dollar fell against the yen on Thursday as lingering worries about global trade tensions weighed on investors' risk appetite. DATA AHEAD (GMT) 1230 U.S. New York Fed manufacturing Mar 1230 U.S. Import prices Feb 1230 U.S. Export prices Feb 1230 U.S. Weekly jobless claims 1230 U.S. Philly Fed business index Mar 1400 U.S. NAHB housing market index Mar PRICES BASE METALS PRICES 0142 GMT Three month LME copper 7004.5 Most active ShFE copper 52360 Three month LME aluminium 2093 Most active ShFE aluminium 13945 Three month LME zinc 3233 Most active ShFE zinc 24810 Three month LME lead 2395 Most active ShFE lead 18495 Three month LME nickel 13835 Most active ShFE nickel 104200 Three month LME tin 21195 Most active ShFE tin 144820 BASE METALS ARBITRAGE LME/SHFE COPPER LMESHFCUc3 939.75 LME/SHFE ALUMINIUM LMESHFALc3 -1367.78 LME/SHFE ZINC LMESHFZNc3 643.77 LME/SHFE LEAD LMESHFPBc3 153.53 LME/SHFE NICKEL LMESHFNIc3 976.21 ($1 = 6.3075 Chinese yuan renminbi) (Reporting by Melanie Burton; editing by Richard Pullin)

2018 03/15

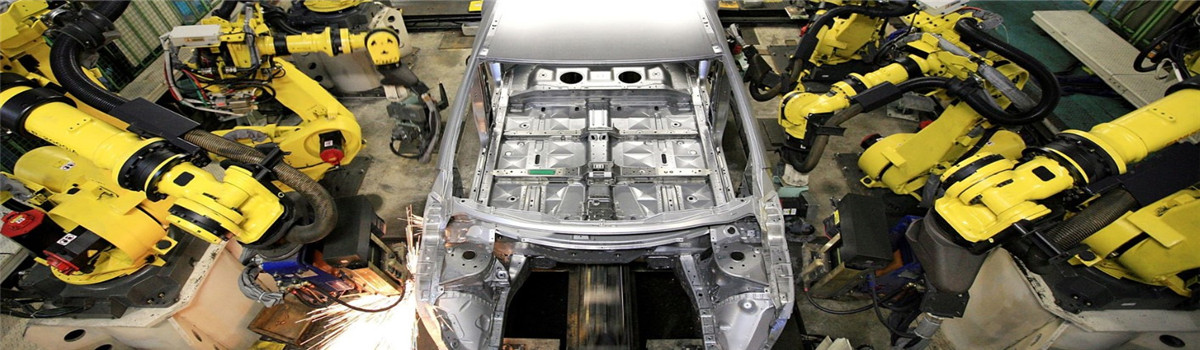

- China industrial production grows faster than expectedWorkers check steel bars at a factory in Dalian, Liaoning province. China`s industrial output in January-February rose 7.2% from the same period a year earlier, the National Bureau of Statistics said yesterday. Reuters/Beijing China`s industrial output grew much faster than expected at the start of the year, suggesting the economy may be picking up momentum even as US President Donald Trump readies hefty tariffs against one its most strategic growth drivers – technology. Tariffs on tech exports could potentially hit the fastest growing segment of China`s industrial sector, an area that the country`s leaders have been keen to promote as they push for [higher quality" economic growth. Trump is seeking to impose tariffs on up to $60bn of Chinese imports in the very near future and will target the technology and telecommunications sectors, Reuters reported on Tuesday. The latest US trade threat, which follows the imposition of tariffs on steel and aluminium last week, overshadowed unexpectedly robust Chinese industrial and investment data for the first two months of the year. [There is a good possibility that Trump will do a lot more against China...The trade situation is obviously a rising risk and a relatively new challenge for China," said economist Kevin Lai at Daiwa Capital Markets in Hong Kong. Industrial output in January-February rose 7.2% from the same period a year earlier, the National Bureau of Statistics said yesterday, surpassing analysts` estimates for a rise of 6.1% and picking up sharply from 6.2% in December. Analysts had expected a slight stumble due to a crackdown on heavily polluting industries, but the data showed China`s steel output rose to its highest in months as mills prepared for a seasonal pick-up in construction in spring. Coal and power output were also up sharply, possibly reflecting a spell of bitterly cold weather. Reflecting China`s growing focus on the production of higher-value goods, the output of computers, telecommunications equipment and other electronics rose 12.1% on year, extending a long period of double-digit growth. Output of industrial robots rose around 25%. However, data from China early in the year is typically treated with caution due to distortions caused by the timing of the week-long Lunar New Year celebrations, which fell in late January 2017 but started in mid-February this year. As such, a clearer picture of China`s economic health may not emerge until first-quarter data is released in April. Many economists expect China`s growth to moderate this year, weighed down by a cooling property market and the government`s clampdown on riskier lending practices, which is pushing up corporate borrowing costs. But most readings available so far, ranging from output to property investment to business surveys, suggest China`s growth has picked up so far this year, keeping a synchronized global recovery on track. Upbeat trade data last week had tipped a stronger industrial showing, with exports unexpectedly surging at the fastest pace in three years in February even as trade relations with the United States rapidly deteriorate. China runs a $375bn trade surplus with the United States and when President Xi Jinping`s top economic adviser visited Washington recently, the administration pressed him to come up with a way of reducing that number. [While risks of escalation in US-China trade tensions exist, we expect China to remain relatively restrained in its response and, as a result, overall economic damage to stay contained," Louis Kuijs, head of Asia economics at Oxford Economics said in a note. China`s electronics and tech exports account for 43% of its total exports to the United States. Economists at UBS estimate that a 10% tariff would cut 0.3-0.4 percentage points from China`s GDP growth and possibly knock other Asian countries which are closely tied into its supply chains.

2018 03/16

Email to this supplier